Pocket Option Schedule Understanding the Trading Hours

Pocket Option Schedule: Everything You Need to Know

In the fast-paced world of online trading, having access to the right information at the right time can make all the difference. One key component that every trader should familiarize themselves with is the Pocket Option Schedule Pocket Option horario. Understanding the trading schedule can help you optimize your strategies and make informed trading decisions.

What is Pocket Option?

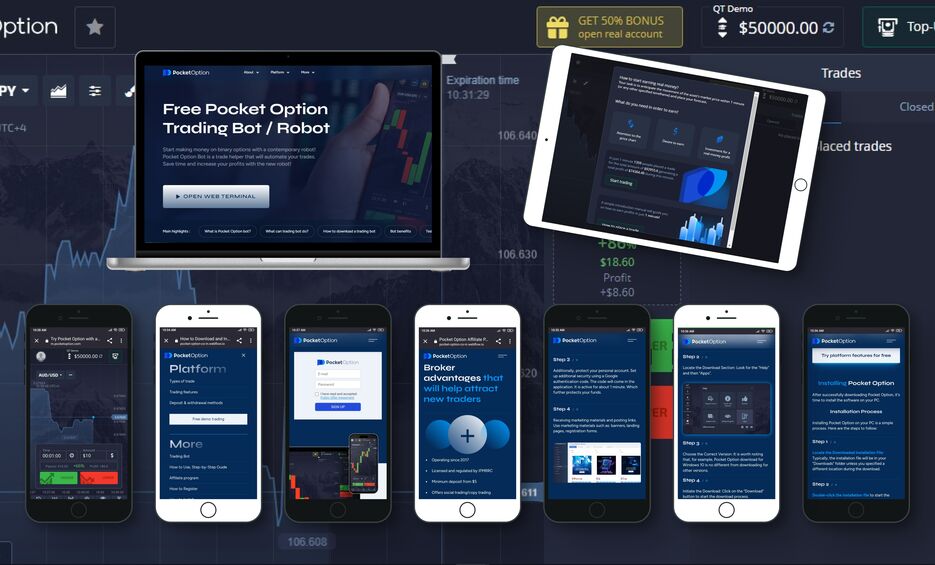

Pocket Option is a popular online trading platform that allows users to trade various financial instruments, including forex, cryptocurrency, stocks, and commodities. Its user-friendly interface and extensive range of tools make it a preferred choice among both novice and experienced traders. The platform also provides a demo account, allowing beginners to practice before committing real funds.

Importance of Knowing the Trading Schedule

Every trading platform operates on specific hours that align with the financial markets. In the case of Pocket Option, understanding the schedule allows traders to:

- Optimize Trading Strategies: Knowing when the markets are most active can help you choose the best times to place your trades.

- Avoid Losses: Trading during off-hours can lead to increased risks due to lower liquidity and higher spreads.

- Plan Ahead: By understanding the Pocket Option schedule, you can plan your trading week efficiently and align it with market dynamics.

Pocket Option Trading Hours

The Pocket Option schedule varies according to the type of market and instruments being traded. Generally, the platform operates 24/7, allowing traders to participate in the markets at their convenience. However, specific instruments may have defined opening and closing hours:

Forex Trading Hours

Forex trading is divided into four major sessions: the Sydney, Tokyo, London, and New York sessions. Here are the general hours for each:

- Sydney Session: 10 PM – 7 AM GMT

- Tokyo Session: 12 AM – 9 AM GMT

- London Session: 8 AM – 5 PM GMT

- New York Session: 1 PM – 10 PM GMT

Overlap between these sessions often leads to increased volatility, making them ideal for trading.

OTC Market Hours

Pocket Option offers OTC (Over-The-Counter) trading, which allows for trading without the need for a traditional stock exchange. The OTC market operates round-the-clock, providing flexibility for traders in various time zones. However, it is important to note that liquidity may vary depending on the time of day.

Cryptocurrency Trading Hours

The cryptocurrency market operates 24/7, making it one of the most accessible trading environments. However, traders should be aware that price volatility can vary significantly between different times of day and during specific events, so understanding trends is crucial.

How to Access the Pocket Option Schedule

To maximize your trading potential, you can find the Pocket Option schedule, including market opening times and specific trading details, directly on their website. By staying updated on their schedule, you can effectively plan your trading activities and improve your overall performance.

Conclusion

Understanding the Pocket Option schedule is essential for any trader looking to succeed in the fast-paced world of online trading. By knowing when to trade and the optimal times to engage with specific markets, you can significantly enhance your trading strategies. Utilize the provided resources on their platform to stay informed and maximize your trading potential.

FAQs About Pocket Option Schedule

1. Can I trade on Pocket Option anytime?

Yes, Pocket Option allows for 24/7 trading, particularly with cryptocurrencies and OTC products. However, it’s advisable to be aware of market trends for optimal results.

2. What are the benefits of trading during specific hours?

Trading during high-volume times often leads to better pricing and less volatility, improving your chances of making profitable trades.

3. How can I stay updated with the schedule?

Visit the official Pocket Option website for their latest trading schedule updates and market hours, ensuring you are always in the loop.

4. Is there a difference in trading on weekends versus weekdays?

Yes, trading during the weekdays typically features higher liquidity and activity compared to weekends when many markets may be closed or less active.

5. How do I apply this knowledge to my trading strategy?

Incorporate the trading hours into your plans and strategies, ensuring that you are trading at the most advantageous times based on the instruments you are focused on.

Leave a Reply